Currency Whiplash: The Hidden FX Costs in Fixed-Bid Contracts

Your fixed-bid contract may be rock-solid, but the INR-USD rate definitely isn’t. Learn how to protect your margins.

How 2024–25 exchange rate swings are sneakily padding your offshore project budget

You finally locked in that sweet offshore dev contract. Fixed-bid. Predictable costs. Dollar-denominated. No surprises, right?

Wrong. You’re probably getting silently whacked by the foreign exchange gods.

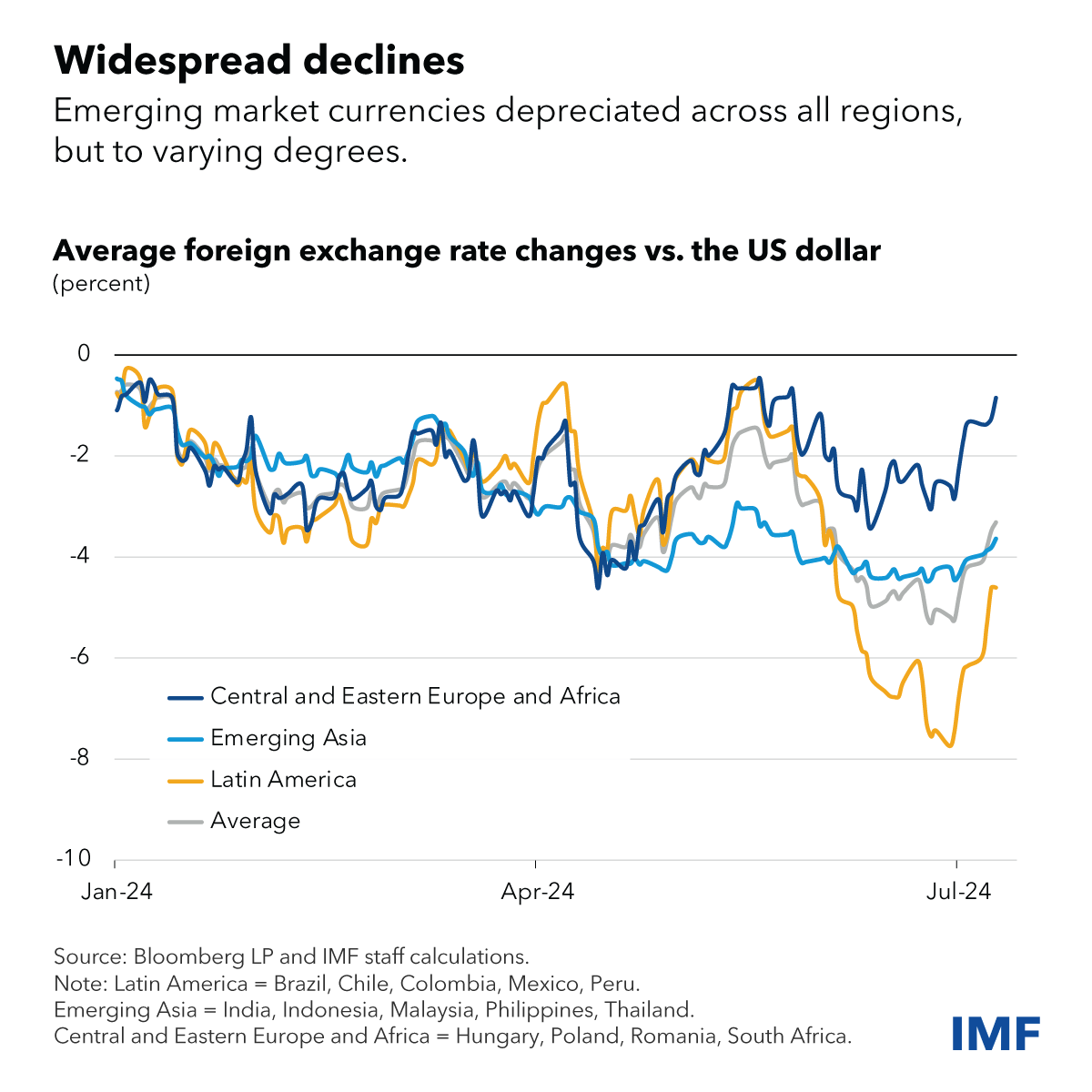

If you’ve scoped, signed, and shipped a project with an offshore partner in the past year, there’s a good chance you’ve eaten 4–7% extra in budget bloat - without a single change request or sprint overrun. The culprit? FX volatility that most finance teams underestimate and most procurement teams ignore until it’s too late.

Let’s break down how this sneaky cost creeps in, what you can do about it, and how we at 1985 manage currency risk so you don’t get blindsided.

“But It’s a Fixed Price!”

Why your CFO is still bleeding money

Let’s start with the illusion of safety: the fixed-bid contract. On paper, it looks like a smart hedge. You pay $X for Feature Y - no matter what happens.

But if your offshore partner operates in a different currency zone (say INR, IDR, or PHP), they’ve quoted you a price that makes assumptions about future exchange rates. And unless they’re running a Wall Street-grade treasury desk, they’re doing what everyone does: padding their quote with a “buffer” or just…hoping.

Now flip it. If you’re the vendor billing in foreign currency, your margin might look fine on Monday and start evaporating by Friday. We’ve seen INR-USD shift by 2.5% in a week. When that happens mid-sprint, you either eat the loss - or quietly renegotiate scope. Neither is fun.

Here’s the kicker: the whiplash effect doesn’t show up on any burndown chart. It hits in your P&L, not Jira.

The Quiet 6% Tax

One real-life project, three currencies, and a bucket of confusion

We once inherited a US-funded fintech project mid-way through dev. The client had signed a six-month, $240K contract with a boutique firm in Pune. They scoped it to the dot. But by month five, their PM quietly flagged a $15K variance.

Why?

The INR had appreciated nearly 5% against the USD since the start of the contract. The original quote assumed 84.5. By May, it was hovering at 80.3. The Indian team didn’t hedge, didn’t reprice, and couldn’t absorb the hit. So they dragged delivery, introduced “change requests,” and gently pushed back on testing feedback.

The client thought they were dealing with bad faith. The vendor thought they were surviving.

Nobody realized they were both getting sucker-punched by FX.

No One Teaches You This in B-School

But you’ll learn it in the school of wire transfers

Let’s be real. Unless you’ve managed multi-currency invoices firsthand, FX feels like a footnote. Something the finance team “handles.” But in dev outsourcing - especially at fixed bid - it’s an invisible enemy.

Here’s what typically happens:

- Q1 optimism: USD/INR is stable, everyone’s feeling good.

- Mid-year volatility: US inflation prints or an unexpected rate cut jolts markets.

- Vendor panic: Your offshore partner revisits margins, starts ghosting on Slack, or nudges you toward a “Phase 2” contract with new rates baked in.

- Client confusion: You think it’s scope creep. It’s actually survival creep.

You don’t want your sprint velocity tied to Jerome Powell’s lunch speech.

Hedging: Not Just for Goldman Sachs

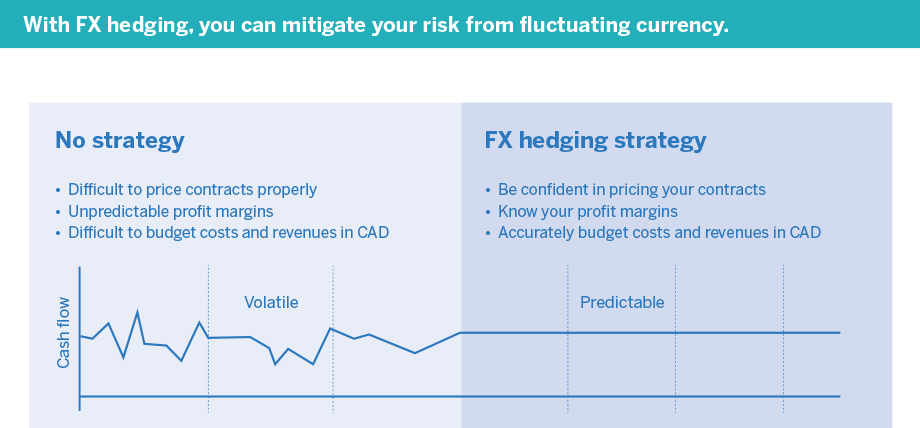

How to bulletproof your fixed-bid budget

Alright, here’s the part most blogs skip: how do you fix this?

We’ve tried it all - forex buffers, split-currency billing, even paying vendors weekly to minimize exposure. What works best depends on the deal size, duration, and how allergic your CFO is to complexity.

Here’s our cheat sheet for FX-proofing your fixed-bid work:

- Quote in local currency (if you're the vendor)

If you're in Bangalore or Manila and billing a US client, quote in INR or PHP and let the client handle the FX. Easier said than done, yes - but you're at least not carrying silent exposure. - Fix your exchange rate for the contract

Use an FX platform like Wise Business or Revolut Business to lock a rate and transfer in bulk. Even traditional banks offer rate-locks now - ask your RM. - Invoice in tranches with FX-adjustment clauses

For multi-month builds, split the contract into milestones and allow a small rate adjustment per tranche (say, ±2% window). More negotiation up front, less drama later. - Use an invoicing buffer, but be transparent

If you must pad your quotes (say 3–4%), disclose it. Good clients get it. Bad clients will find out eventually - at sprint 6. - Go monthly or bi-weekly billing over lump sums

Smaller billing cycles reduce the odds of a massive FX shift gutting your margin.

For deals above $100K, we also recommend a two-currency ledger: one side in your local ops currency, one in client billing currency. It’s a bit more bookkeeping, but gives you clarity on real versus nominal revenue.

How We Do It at 1985

Risk-hedged, stress-tested, and slightly paranoid (in a good way)

We learned all this the hard way - through blown margins, grumpy clients, and more Excel FX recon sheets than we care to admit.

So now, we build currency hedging into our risk-mitigation SOP. Here’s how we handle fixed-bid or long-term dev work:

- All our quotes are pegged at a reference FX rate. We share this rate with the client and state clearly: if INR/USD crosses X%, we’ll mutually revisit.

- We batch hedge for multi-month contracts. Using RazorpayX for INR and Wise for USD/EUR flows, we fix our exposure up to 6 months out.

- Split-currency contracts are always on the table. If the client wants USD billing but we’re paying engineers in INR, we offer an optional INR billing track - especially for India-based startups.

- Sprint-based renegotiation triggers. If FX volatility exceeds 3% within a month, our ops team flags it internally to reprice or absorb based on delivery status.

And if all else fails, we talk it out. We’d rather have a tough phone call than passive-aggressive emails.

Don’t Let the Rupee Eat Your Roadmap

An 8-point FX checklist for dev leaders

Whether you’re building in-house or outsourcing to Bangalore, FX isn’t just a finance problem. It’s a project health problem. So here’s your sanity-saver checklist:

- Know your FX baseline before you sign.

- Confirm how your vendor priced the contract - buffered or real-time?

- Ask about their FX mitigation tactics.

- Avoid long fixed-bid cycles without tranches.

- Build in FX clauses for multi-month deals.

- Keep the finance team in the sprint loop (really).

- Track your effective spend monthly in both currencies.

- Don’t assume stability - assume surprises.

A 6% surprise on a $300K build isn’t small change. That’s an entire QA cycle. Or a bonus round you’ll now have to skip.

Budget Like a Trader, Ship Like a Founder

We live in an age where AI models hallucinate, microservices sprawl like weeds, and even solid-sounding sprint plans go sideways. Add volatile currencies to that soup, and it’s amazing anything ships on time.

But that’s the job.

So the next time you’re negotiating a fixed-price contract across borders, remember: it’s not just about features, timelines, or headcounts. It’s about currency physics. Hedge it. Talk about it. Price it in.

Or get ready to explain to your boss why a $180K quote somehow became $196,320.

Want to work with a partner who already thought about this stuff? Spin up a sprint with 1985’s offshore squads. We’ve got the FX drama handled.

FAQ

1. Why do fixed-bid contracts still carry FX risk if the price is locked?

Because even though the client sees a static dollar figure, the vendor’s cost base is often in a different currency. If INR, IDR, or PHP fluctuates significantly against the USD, the real cost of delivering the project changes, creating hidden profit or loss for the vendor.

2. How much can FX volatility impact a typical offshore contract?

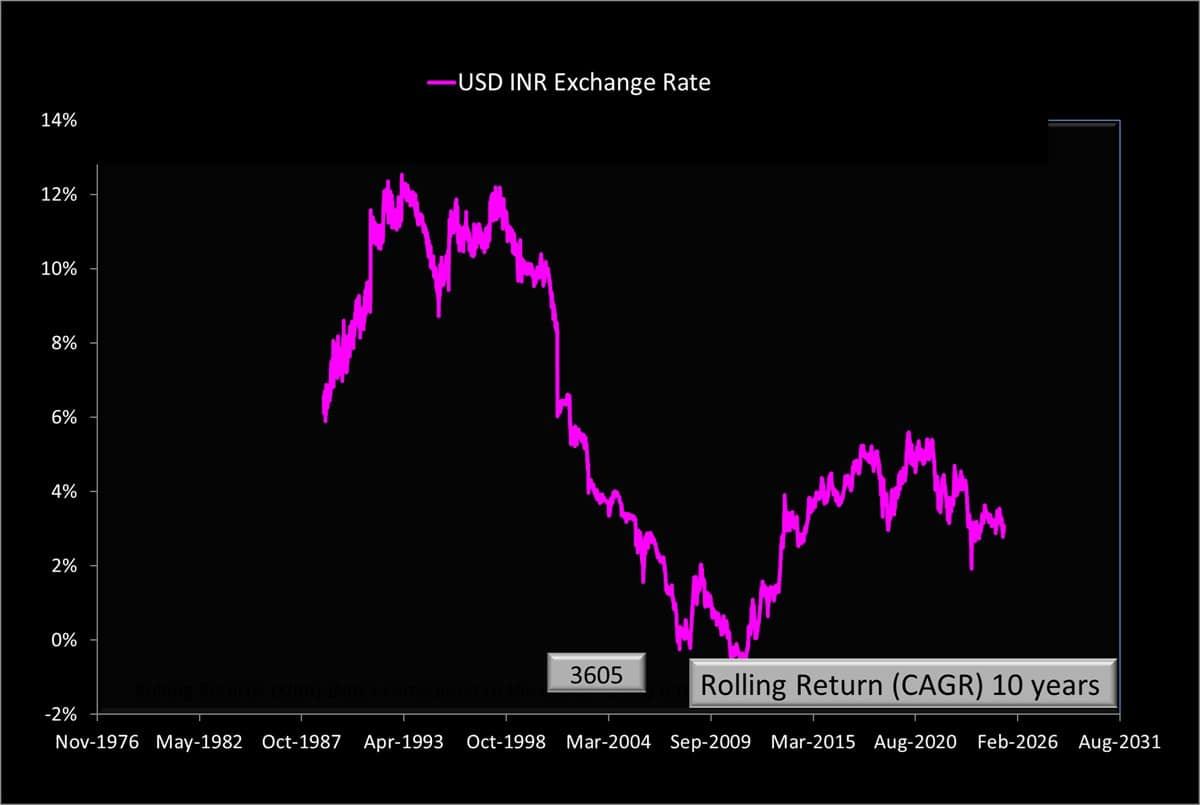

In 2024–25, common INR/USD fluctuations of 4–7% can translate to $10K–$30K swings on mid-sized ($250K–$500K) projects. This isn’t theoretical - it’s already affecting offshore vendors' margins and, in some cases, delivery timelines.

3. Isn’t it the vendor’s job to absorb that risk?

In theory, yes. But in reality, many vendors don’t hedge. They either build in hidden buffers (making you overpay) or scramble to adjust scope, quality, or pace when the currency moves. The smarter approach is to share risk transparently upfront.

4. Should clients ask vendors how they handle FX?

Absolutely. Asking about their FX assumptions, buffers, and mitigation strategies is as important as reviewing their tech stack or delivery model. It helps both sides avoid surprises mid-project.

5. What’s the best way to structure contracts to reduce FX exposure?

Tranche-based billing with a clearly stated base exchange rate is ideal. This allows for minor adjustments per milestone if currency moves beyond a predefined band, while keeping both parties aligned on the real cost.

6. Are monthly billing cycles better than lump-sum payments for FX?

Yes, because they reduce the window of exposure. Shorter billing cycles let both parties respond to FX swings in real time, rather than carrying a months-long risk silently under a single fixed bid.

7. How do we calculate the right buffer if we want to keep pricing in USD?

Start by looking at historical volatility - say, the average monthly USD/INR swing over the past year. A 3–5% buffer is typical, but only if you revisit the rate quarterly. Otherwise, consider using a rolling average or consult your FX platform for forward rate projections.

8. Can tech platforms help with hedging FX risk for smaller vendors?

Yes. Tools like Wise Business, RazorpayX, and Revolut offer mid-market exchange rates, allow bulk transfers, and sometimes even rate locks. They’re especially useful for startups and mid-size vendors that don’t have treasury desks.

9. What happens if FX shifts dramatically mid-project and no clause was included?

You’re in murky territory. Vendors may push for renegotiation or quietly reduce effort. Clients may push back citing “fixed price.” It’s best to avoid this drama entirely by addressing FX during contracting, not after the fact.

10. What’s 1985’s approach to managing FX risk in its offshore contracts?

We peg all fixed-bid contracts to a reference FX rate and disclose it. If the rate swings more than 3%, we trigger a mutual review. We also hedge multi-month cash flows using Wise and RazorpayX and offer INR billing options for Indian clients. Our goal is zero surprises - for you or for us.